Introduction

Welcome to our blog where we share interesting and informative articles. In this blog, we discuss financial customer service. We also explore whether live chat support or chatbots are better for your financial business. We’ll break it down in simple terms so you can make an informed decision.

The Importance of Customer Service in Finance

Why is it so important?

- Customer Satisfaction: When you can get the answers you need quickly and easily, you’re a happy customer. Good customer service means happy clients and happy clients tend to stick around.

- Building Trust: Trust is a cornerstone of the financial industry. If customers trust your services, they’re more likely to invest, save, or do business with you. Great customer service helps build that trust.

- Problem Solving: Financial matters can be complex. Whether it’s a question about a transaction or a concern about account security, customers want reliable help. Customer service teams are there to solve these problems.

What is Live Chat Support

Live chat support is an online service that lets you chat with real people in real-time. Imagine walking into a bank, and there’s a friendly teller ready to assist you. Live chat support offers a similar experience, but it happens through your computer or smartphone.

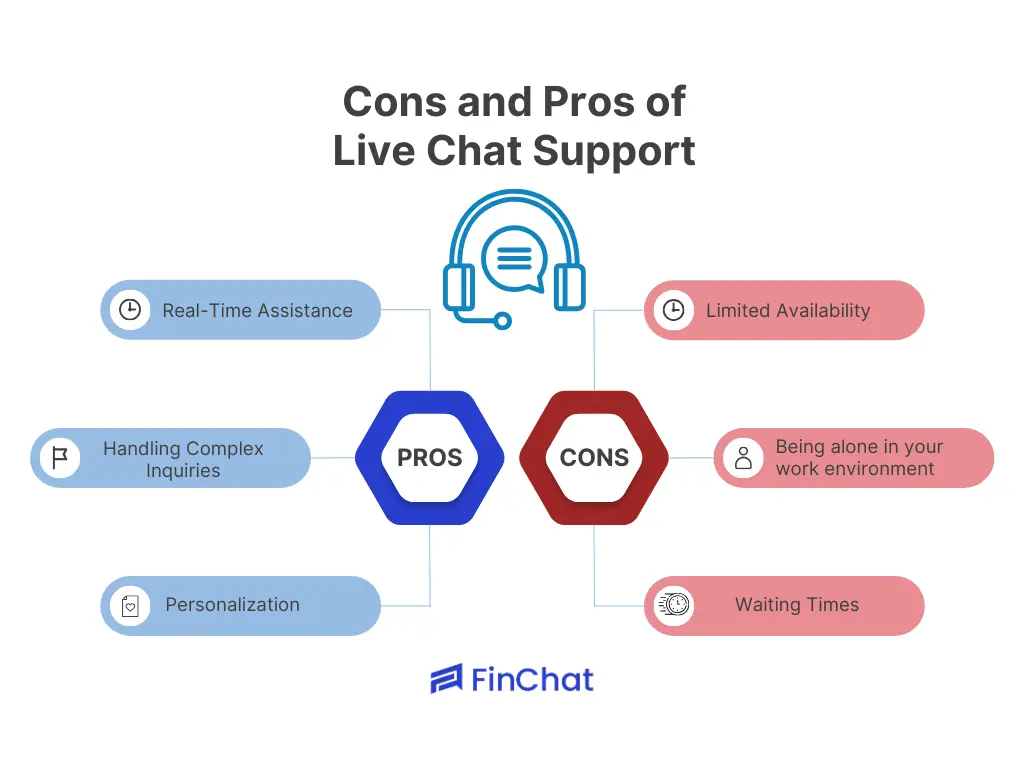

Pros of Live Chat Support

- Real-Time Assistance: One of the big advantages of live chat support is that it’s lightning-fast. You type in your question, and within seconds, you get a response. No waiting on hold or delayed email replies.

- Personalization: When you chat with a live support agent, you’re talking to a real human being. They know what you need and can help you personally.. It’s like having a financial advisor just for you.

- Handling Complex Inquiries: Financial matters can be complicated, right? Well, live chat support agents are like experts in the field. They can navigate through complex issues and offer guidance when you need it most. Whether it’s a question about a transaction or a concern about account security, they’ve got you covered.

Cons of Live Chat Support

- Limited Availability: Unlike chatbots that are available 24/7, live chat support might have specific operating hours. If you need assistance outside those hours, you might have to wait.

- Waiting Times: During peak hours, you might experience some wait time before connecting with a live agent. It’s similar to standing in line at a busy bank branch.

- Human Error: Although live agents are experts, they’re still human, which means they can make mistakes. While these errors are usually minor, it’s something to keep in mind.

What is Chatbots

Chatbots are computer programs designed to chat with users and provide information or assistance. Think of them as your always-available virtual financial advisors, ready to assist with your queries and tasks.

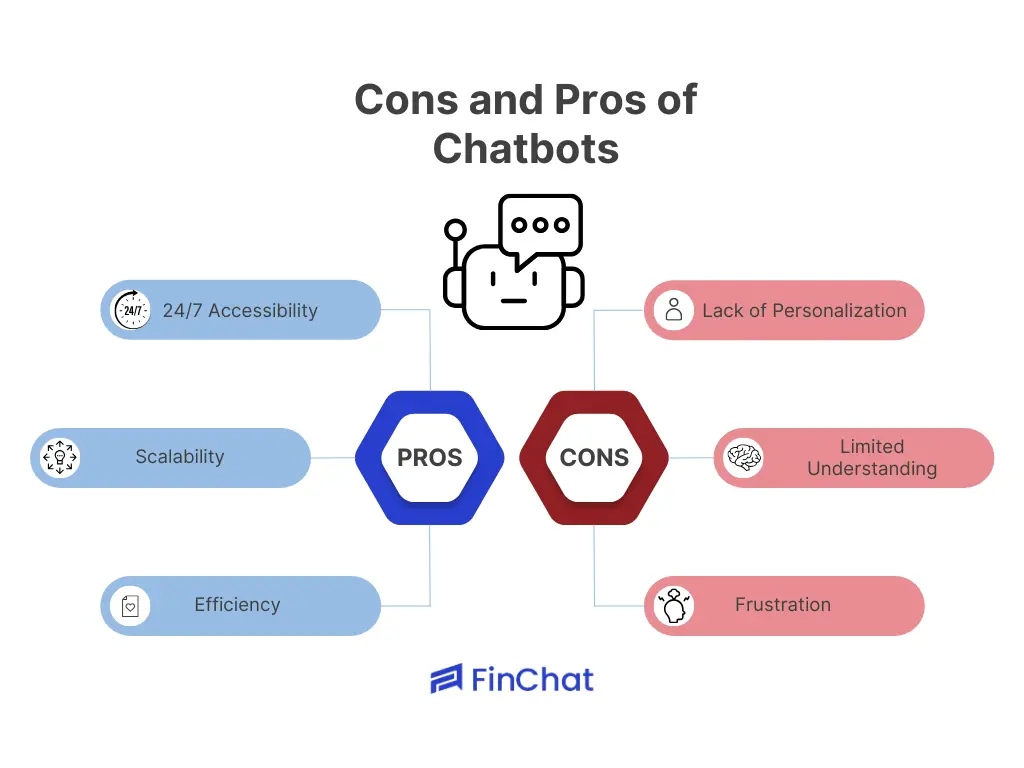

Pros of Chatbots

- 24/7 Accessibility: Chatbots are always accessible, without any downtime or breaks. They are available 24/7, each day, to assist you. This implies that you can seek help whenever required, be it during late hours or festive occasions.

- Scalability: Chatbots have impressive scalability. They can manage several chats at the same time without any strain. Hence, regardless of whether you have ten clients or a thousand, chatbots are capable of meeting the need.

- Efficiency: Chatbots excel at handling routine inquiries. They are capable of swiftly responding to frequent inquiries like verifying account balances, reviewing transaction history, or offering fundamental details about financial offerings.

Cons of Chatbots

- Limited Understanding: Chatbots are not mind readers. They might struggle to understand complex or nuanced questions. If you have a highly specific or unique inquiry, a chatbot may not be the best choice.

- Lack of Personalization: Chatbots cannot provide the same level of personalized assistance as a human because they automate their responses. They may forget your previous interactions or tailor their responses to your specific needs.

- Frustration: In some cases, customers may find themselves frustrated if a chatbot can’t understand or address their concerns. It’s like talking to a helpful but slightly limited robot.

Use Cases and Scenarios

Live Chat Support

- Complicated financial planning: Think about planning for your retirement and having many detailed questions about investing, taxes, and managing risks. In circumstances like these, live chat support truly excels. A human agent can provide personalized advice and guide you through the complexities of financial planning.

- Fraudulent Activity: If you suspect fraudulent activity on your account, you want quick and reliable assistance. Live chat support can swiftly address your concerns, investigate the issue, and take necessary actions to secure your accounts. The human touch is reassuring during such critical moments.

Chatbots

- Account Balance Inquiries: It’s a typical scenario – you want to check your account balance quickly. Chatbots excel in handling routine tasks like this. They can provide instant responses, giving you the information you need without any delays.

- Transaction History Requests: Need a copy of your recent transaction history? Chatbots can efficiently retrieve this information and send it to you. This saves time and keeps your financial tasks moving smoothly.

Customer Preferences and Expectations

- Shifting Choices: Nowadays, clients have varying choices regarding support channels. Some prefer the convenience and speed of chatbots, while others value the personal touch of live chat support. Offering both options allows you to cater to a broader audience.

- 24/7 Availability: In a world that never sleeps, customers appreciate round-the-clock availability. Chatbots meet this expectation perfectly, ensuring that customers can get assistance at any hour.

- Efficiency Matters: Customers expect quick and efficient service. Chatbots excel in providing instant responses to routine queries, meeting the need for speed.

- Personalization Still Matters: While efficiency is essential, personalization remains a key factor in customer satisfaction. Live chat support can offer that personalized touch, making customers feel valued and understood.

- Meeting Customer Needs: Ultimately, the right choice between live chat support and chatbots depends on your customers’ needs and preferences. Some situations call for the expertise and empathy of a human agent, while others benefit from the efficiency of a chatbot.

Combining Forces: The Hybrid Approach

Where Both Live Chat Support and Chatbots Work Together

In the constantly changing realm of customer service, financial organizations are finding a potent strategy: the hybrid method. The emphasis is not on selecting between live chat and chatbots; instead, it’s about leveraging both to boost customer engagement.

What’s the Hybrid Approach?

Imagine this, You walk into a high-tech bank, and a friendly human teller greets you. But just beside them, there’s a super-efficient robot ready to assist with routine tasks. That’s the essence of the hybrid approach in financial customer service. It’s the combination of live chat support, where human agents provide personal assistance, and chatbots, which excel in handling repetitive tasks.

Benefits of the Hybrid Approach

- Best of Both Worlds: With a hybrid approach, you get the best of both live chat support and chatbots. Human agents offer personalized assistance for complex inquiries, while chatbots handle routine tasks swiftly.

- 24/7 assistance: Chatbots operate continuously without the need for rest or breaks, which is highly advantageous. They can provide 24/7 support, ensuring that customers can get assistance whenever they need it.

- Efficiency and Speed: Chatbots are lightning-fast in handling simple queries. This efficiency can significantly reduce wait times and improve overall customer satisfaction.

Making the Right Choice

When it comes to providing top-notch customer service in the financial industry, making the right choice between live chat support and chatbots is crucial. Let’s explore how financial institutions can decide which option suits their specific needs, check this out:

- Know Your Customer Base: Start by understanding your customer base. Are they tech-savvy and prefer quick responses, or do they value a personal touch? Knowing your customers’ preferences is key.

- Consider Inquiry Complexity: Think about the types of inquiries you receive. If they tend to be straightforward and routine, chatbots can handle them efficiently. For more complex questions or situations, live chat support with human agents might be the better choice.

- Budget Constraints: Budget is a significant factor. Chatbots can be cost-effective in handling routine tasks and reducing the workload on human agents. However, investing in live chat support might be necessary for providing personalized assistance.

- Scalability Needs: Consider the volume of inquiries. If your institution deals with a large number of customer requests, chatbots can help manage the workload effectively. They can scale up to handle multiple conversations simultaneously.

- Customer Feedback: Listen to what your customers are saying. Their feedback can provide valuable insights into their preferences and the effectiveness of your current customer service methods.

Conclusion

In the dynamic world of financial customer service, the choice between live chat support and chatbots is pivotal. We’ve delved into their advantages and limitations, equipping you to make an informed decision that suits your unique needs.

Customer satisfaction, trust-building, and efficient problem-solving are at the core of exceptional financial service. Your customer base, inquiry complexity, budget constraints, scalability requirements, and customer feedback all influence your choice.

At FinChat, we understand the unique challenges and demands of the financial industry. We’re here to empower your financial institution with cutting-edge customer service solutions. If you need help with live chat or chatbots, we can assist you to succeed.

Take the next step in elevating your customer service experience. Click here to explore how FinChat can be your trusted partner in financial communication solutions. Together, we’ll ensure that your customers receive the exceptional service they deserve.